Can You Write Off Wedding Expenses? A Tax Expert Weighs In

When paying for a wedding, it's no surprise that couples might look for ways to cut costs and stick to a wedding budget. You might even wonder, can you write off wedding expenses? Well, in some cases, the answer is yes. It won't counteract the costs of your entire bill, but if you take a few actions around your planning, you can create a few wedding tax write-offs. Since you don't want to try to write off all your wedding costs and end up in trouble with the IRS, we asked Lisa Greene-Lewis, CPA and tax expert with Intuit TurboTax, to give us insights on what expenses you can write off from your wedding day. See all the details ahead.

In this article:

- Can You Write Off Wedding Expenses?

- 8 Tax-Deductible Wedding Expenses

- Wedding Expenses That Aren't Tax Deductible

Can You Write Off Wedding Expenses?

In short, the only wedding expenses that you can write off are those that are turned into charitable donations. "It can be possible if you donate certain expenses related to your wedding to a 501(c)(3) non-profit charitable organization and you can claim itemized deductions versus standard deductions," Greene-Lewis explains. "Typically people who can itemize their deductions are homeowners who can claim expenses like home mortgage interest and property taxes and their itemized deductions are more than the standard deduction which for tax year 2024 is $29,200 for married filing jointly." Donating items like wedding food, flowers and attire to a charitable organization that can give you a formal receipt can be written off in your taxes.

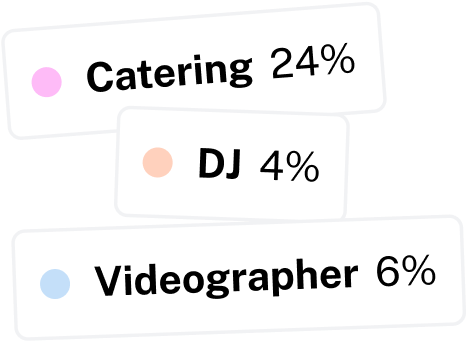

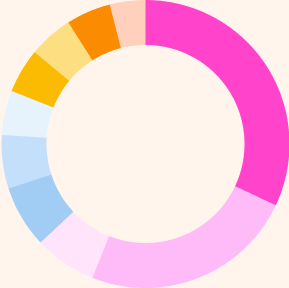

8 Tax-Deductible Wedding Expenses

So, are wedding expenses tax deductible? Ahead, see the items you can write off in your taxes to offset costs and save money on your wedding.

Flowers

Florals are often a big part of a couple's wedding budget breakdown. Luckily, you can give flowers and centerpieces to charity at the end of your event to get a write-off. "If you donate certain items like flowers and you can itemize your deductions, you may be able to claim your wedding expenses as a charitable deduction," Greene-Lewis says. Organizations like Repeat Roses can help you in this process.

Food

Extra food from your wedding event shouldn't go to waste. Instead, organize to have leftovers donated to your local homeless shelter. If you receive a receipt from the non-profit you can apply this to your wedding expenses tax deduction as a charitable donation.

Decorations

Decorations like candles, linens and more can be donated after your celebration to your local Goodwill or other charity stores. Just be sure to get a receipt to itemize your donation.

Wedding Dress

If you're only going to wear your wedding dress once, you can let someone give it a second life. Donate it to your local Goodwill or The Salvation Army, or send it to organizations like Brides Against Breast Cancer. They will be able to provide a receipt for a tax write-off.

Wedding Party Attire

Your wedding party can also donate their wedding day attire like dresses and suits to organizations and use it as a write-off on their own taxes. Or, if you paid for the attire yourself, include it in your wedding tax write-off.

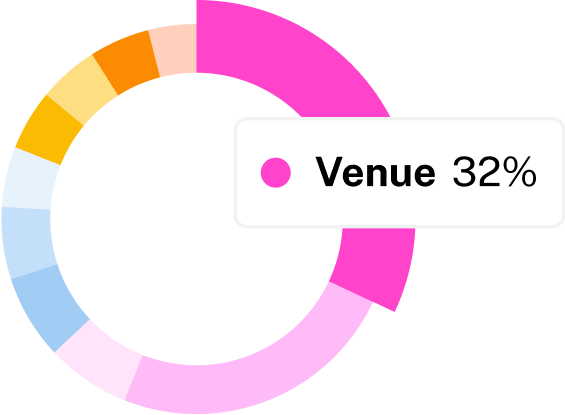

Venue

In the case that your venue is a charitable organization, it may be possible to write off a portion of your expenses. "If your wedding venue is at a historical location like a museum, garden or state or national park, you may be able to deduct what you paid for the venue as a charitable contribution as long as the fees are for the preservation of the historical location," Greene-Lewis says. Many venues will indicate if this is possible when you're making booking arrangements.

Church

"If you have your wedding at a church, you may be able to deduct any additional donation you make to the church outside of the fees paid for the service," Greene-Lewis says. "If you are paying a ceremony fee, the fee itself won't be tax deductible because it is paid in exchange for receiving a service. However, any additional donation to the church with no expectation of benefit can be deductible."

Charitable Favors

Some couples choose to donate to a charitable organization on behalf of their guests in lieu of offering favors. In this case, a couple can write off whatever the donation was on their taxes.

Wedding Expenses That Aren't Tax Deductible

While any charitable contributions can be considered tax deductible for your wedding, Greene-Lewis clarifies that there's not much wiggle room on other expenses. She emphasizes it's best to work with a tax professional to ensure your itemized charitable deductions are filed properly.

Work in the wedding industry and think your wedding could be a business write-off? Think again. "If a couple works in the wedding industry, it would not allow them to write off more wedding expenses as it relates to their wedding," she says. "While the couple in the industry doesn't qualify for additional write-offs, they may be able to save on their wedding using their industry contacts and knowledge."